January 7, 2015

To find the last change to gasoline taxes, you have to go way back to the early 1990s. It was a simpler time… the Blue Jays were World Series Champions. Roseanne was the most popular sitcom on television, and Nirvana dominated the radio. Back then, the federal and provincial taxes on gasoline were 10 cents per litre and 14.7 cents per litre, respectively.

Touch ’em all Joe, you’ll never hit a bigger one in your life.

Two decades later, our world has changed in some unimaginable ways: We have self-driving cars. CDs and the Space Shuttle are relics. The Jays? They haven’t made the playoffs in a generation. But Toronto has a great basketball team (#wethenorth).

And those gas taxes? Still 10 cents per litre to the federal government and 14.7 cents to the provincial government.

The price of gas can be a sensitive political issue. Consumers are vocal about gas prices, and retailers are eager to deflect consumer frustration away from themselves by highlighting the role government taxes play in the price of gas at the pump. Understandably, governments wish to avoid being seen as a direct contributor to rising gas prices.

Unlike most taxes, gas taxes are charged as a flat charge per litre, rather than as a percentage of the pump price.

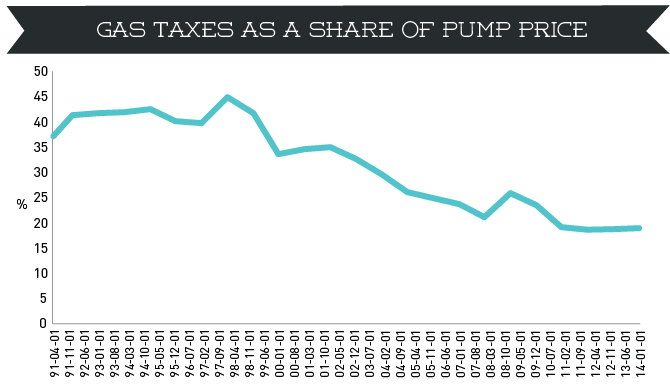

But it wasn’t always like that. Throughout the 1980s, federal and provincial governments adjusted excise taxes on gasoline dozens of times. Then suddenly they stopped — provincially in 1992 and federally in 1995 — and gas taxes have remained the same ever since. But in real terms, gas taxes have decreased, from over 40 per cent of the pump price in 1992 to on average under 20 per cent today.

Source: Ontario Ministry of Energy, NRCan

The author in 1992, inspired by hero Joe Carter. Many things have changed for him, but not the gas tax.

We’d all like to sustain the magic that was the early 1990s. But the sad truth is that the sands of time only move one way. Leaving federal and provincial gas taxes where they stood two decades ago does not serve us well.

Governments should take a serious look at increasing gas taxes. This applies regardless of whether governments increase taxes overall or whether they keep overall tax burdens constant and use the new revenue to reduce other taxes, such as income taxes. No doubt it would take some courage to raise an unpopular tax, but it is the right move from a policy perspective. Here’s why.

Stable revenue

Gas taxes raised $4.3 billion federally in 2013-14, and $3.1 billion for the Ontario government. These taxes are an efficient way to raise revenue. In the short run, drivers are unlikely to change their behaviour much in response to increased gas taxes. A Yale University study found that drivers would only reduce their mileage by about five per cent in response to a 22 cent per litre increase in gas taxes. This is in contrast to corporate income tax revenues, which fluctuate wildly in response to changes in policy and economic conditions. An increase of a few pennies per litre would be less than the fluctuations that drivers have typically seen week to week — though the last few months are an exception to that rule. Even a doubling of federal and provincial gas taxes would only take average pump prices from the level they were at the end of December 2014 to about the level they were at the beginning of November 2014.

The environment

We need to reduce people’s reliance on driving to have a sustainable economy. A major goal of excise taxes is to discourage unwanted behaviour. As the new EcoFiscal commission has pointed out, raising the price of scarce resources is the best way to improve energy efficiency and reduce consumption. The IMF recommends gas taxes significantly higher than what we have today. This is true whether you use the revenue to make new investments or simply to allow you to cut other taxes.

Inflation

In real terms, the value of the gas tax has been consistently decreasing. At the same time, the cost of the goods and services that governments need to pay for have gone up. The federal government has indexed their payments from the Gas Tax Fund — their program to share gas tax revenues with municipalities — to inflation. The gas tax itself, however, has not been.

Rather than cling to the gas taxes of the 90s, someone wanting to recapture the spirit of that bygone era could instead visit the original website for the 1996 classic film Space Jam. It’s still available in its original, untouched, GeoCities-esque form.

— Noah Zon