November 4, 2014

Mowat NFP recently released a report, From Investment to Impact: The NFP experience with Social Impact Bonds as part of its Sector Signal series. Social Impact Bonds (SIBs) are a relatively new idea, and they are generating both a high level of excitement and anxiety.

Advocates of social finance and impact investing see them as a way to create new pools of money to fund important social programs. They are seen as a way to drive innovation and shift funding toward preventive programs that address root causes of social problems rather than crisis-driven interventions.

Skeptics view social impact bonds as a euphemism for privatization—another potential tool for cash-strapped governments to offload social program spending to the private sector or to not-for-profits without sufficient resources.

What is a SIB?

Most social spending is already tied up in crisis services, and preventive services only produce savings to the system many years down the line.

How does it work?

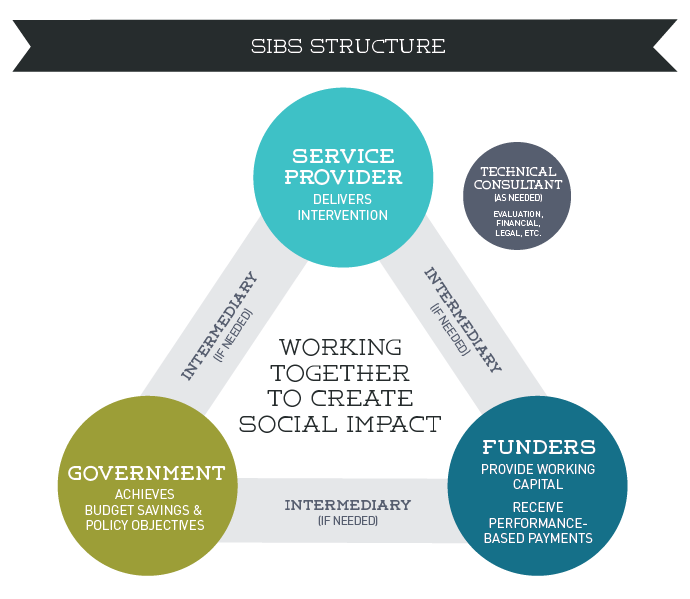

Funding for a SIB may come from traditional for-profit investors or philanthropic sources like foundations. Government, or another funding body that acts as a commissioner, agrees to repay the investors—with a modest return—if the services do indeed work as promised. SIBs can create benefits: fund new interventions that prevent unwanted outcomes (i.e. recidivism, youth unemployment, family separation); not-for-profits secure a new source of funding for delivering innovative solutions; and the public benefits in the long run from savings on expensive services like emergency rooms and prisons by preventing the problems that drive demand for them.

Is a SIB a P3 for social interventions?

Public-private partnerships or P3s have long been used by governments to finance complex, large-scale public infrastructure projects. Social Impact Bonds (SIBs) borrow key features from P3s: they both use private investment dollars to finance public purposes and both allow government to transfer financial risk from taxpayers to the private sector. Whereas P3s are used to finance public infrastructure projects, SIBs are used to fund preventive interventions for social programs upfront, with the promise of a financial return to investors if the program meets its goals. SIBs are a kind of “P3 for people”—”a P4”.

What does this mean for the not-for-profit sector?

While the evidence for their actual success to date is inconclusive, the promise of new investment in Ontario’s charitable sector is a powerful one. Just as strong is the lure of support for innovation, since not-for-profits often have more good ideas than they have money to put into practice.

Social Impact Bonds (SIBs) are a relatively new concept that borrows key features from P3s: they both use private investment dollars to finance public purposes and both allow government to transfer financial risk from taxpayers to the private sector.

But financing public services through financial markets raises concerns. Rather than bringing in new money, some believe that SIBs will divert already scarce resources away from existing program funding, whether by redirecting foundation money or giving governments an excuse to abandon their existing commitments. Some SIB-sceptics suggest it would be easier and cheaper for government to fund these services directly rather than paying a dividend to private investors?

Proponents and skeptics both have valid points and concerns. Our Sector Signal finds that SIBs are succeeding in some areas where funding has been absent, or where previous funding arrangements have failed. For the generally larger, well-connected and well-established not-for-profits who can compete for them, first-generation SIBs have been a positive experience overall, building internal capacity and strengthening strategic relationships. But they are not right for all issues or all organizations.

It is still early days for SIBs and they are unlikely to revolutionize—or even disrupt—the not-for-profit sector in Ontario significantly. Funds are not being diverted en masse, nor have governments been using SIBs to abandon existing obligations. Ontario NFPs have room (and time) to explore whether the SIB model is the right tool for them. They should be at the table to help shape how this tool gets developed and implemented in Ontario.

— Andrew Galley, Elizabeth Sweitzer & Jamie Van Ymeren

Related research

From Investment to Impact

Social Impact Bonds (SIBs) are a new funding tool that uses private capital to fund preventative social interventions.

View this paper

Better Outcomes for Public Services

The latest from Mowat in our ongoing Shifting Gears research partnership with KPMG, this study looks at the growing global trend toward outcomes-based program funding.

View this paper