December 16, 2014

On Monday morning, the federal government announced the major transfer payments to provinces and territories next year. Here’s what we know and what we don’t.

What are the major transfers?

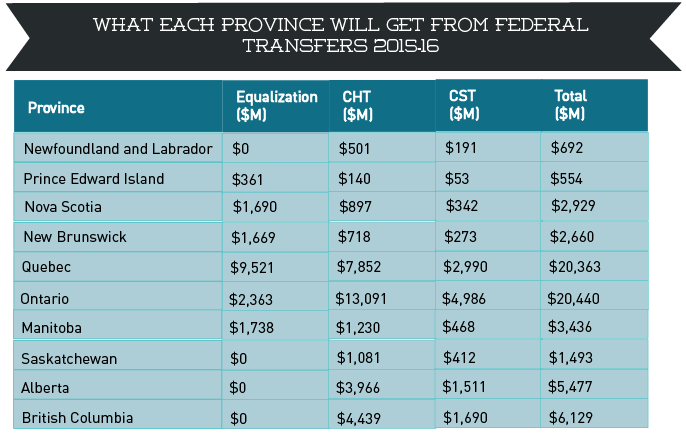

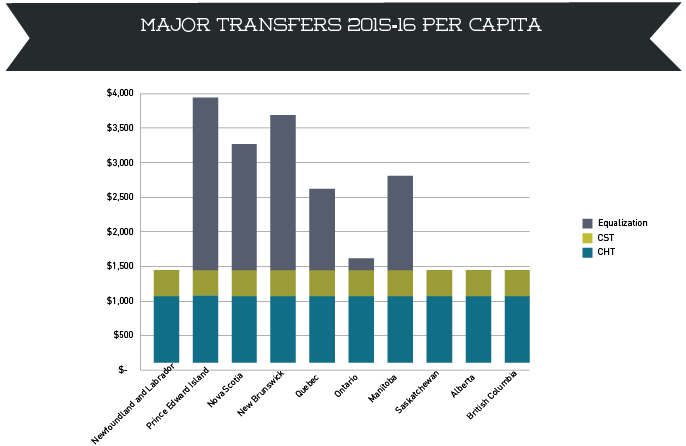

There are four main programs that we think of as the “major” federal transfer payments to provinces and territories. Two of these programs — the Canada Health Transfer (CHT) and the Canada Social Transfer (CST) — are the legacy of the federal government’s contribution to creating our major social programs, such as medicare, and social assistance. These two programs combined represent 69 per cent of the $68 billion in major federal transfers announced for 2015-16.

The remainder of the major transfers are two programs designed to help provinces and territories deliver reasonably comparable public services at reasonably comparable tax rates. The Territorial Formula Financing program ($3.6 billion) helps the three territories, while the Equalization program ($17.3 billion) goes to provinces with below-average capacity to raise revenue.

How have things changed from last year?

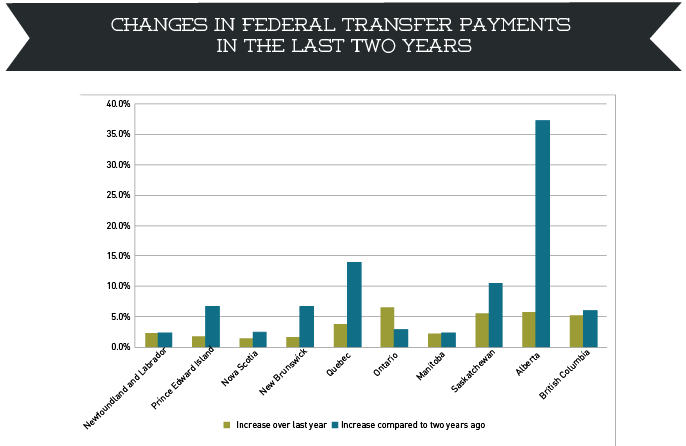

Ontario will see a 6.5 per cent increase next year (2015-16) in its total major transfer payments, compared to this year (2014-15) when the province saw a net decrease. Ontario will see the largest increase next year, followed by Alberta, Saskatchewan and then British Columbia.

Unlike this year, when a number of changes were brought in that saw Ontario’s transfer decline, the coming year is a “return-to-normal” for transfer payments. Although detail is insufficient at this time, it appears that the coming year’s allocations will be driven by the formula.

When allocations were announced last year, changes to the Canada Health Transfer and Transfer Payment Protection resulted in a loss of revenues to Ontario.

If one looks at the change in the level of transfer payments over a two year period, Ontario’s transfer payments this year are up 2.9 per cent since 2013-14. By way of comparison, Alberta’s transfers are up 37.2 per cent and Quebec’s are up 13.9 per cent.

Most of this skew can be attributed to the change last year to move all provinces to equal-per-capita payments for the CHT. When the federal government made a similar change to the CST in 2007, they provided extra transition-year funding to make sure the change did not hurt some provinces to help others. No extra funds were added last year for the CHT, which meant that increasing Alberta’s allocation came at the expense of other provinces.

Does this coming year’s increase mean that Ontario is no longer getting shortchanged?

The Equalization program remains fundamentally flawed. The program, which is supposed to help provinces with below average fiscal capacity, will continue to redistribute approximately $4.5 billion away from Ontario.

The Equalization program remains fundamentally flawed.

Last year’s ad hoc changes by the federal government only made a bad situation worse. The fact that these ad hoc changes have not been replicated for next year does not mean that long-standing structural problems have been addressed, only that they weren’t exacerbated yet again.

An important factor to keep in mind is that these new figures don’t include inequities in other federal transfer programs. These include infrastructure and labour market training. We gave more detail about these in a pair of earlier posts here and here.

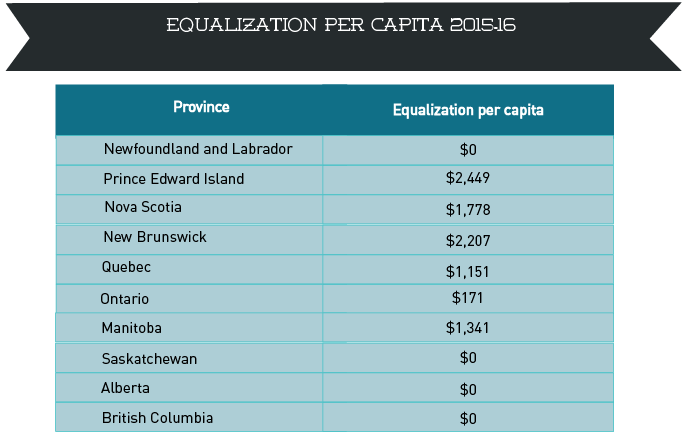

Ontario will receive a higher Equalization payment next year — a 19 per cent increase. However, these payments are relatively modest given Ontario’s population, and at $171 per capita are about $1000 per person less than the next lowest Equalization-receiving province.

Who is getting what next year?

Six provinces will receive Equalization payments next year, four provinces will not.

Federal transfers are determined by a formula based on federal legislation. According to the formulas, the total Canada Social Transfer increases by three per cent and the Canada Health Transfer increases by six per cent (though that rate of growth will slow starting in fiscal year 2017-18). The Equalization program grows at the rate of the Canadian economy (based on a three-year moving average of nominal GDP).

For the CHT and CST, every province receives a share equal to its share of the population — an equal-per-capita approach. For Equalization, how much a province receives is supposed to be based on how their fiscal capacity — a measurement of how much revenue a province could collect with average tax rates — compares to other provinces. In practice, the actual amount that provinces receive doesn’t line up with this formula, as a result of changes made to the program over the last few years.

When we adjust for population and look at what provinces receive on an equal-per-capita basis, we see that they receive $949 per person for health and $361 per person for social programs. The differences come from the Equalization program.

What don’t we know?

Unlike the reasonably straight-forward formulas for the CHT and CST, it is nearly impossible to tell what is happening with the Equalization program based on top-line numbers. For example, this year, a large part of Ontario’s decreased Equalization payments was driven by the decision by Quebec to close its Gentilly-2 nuclear facility. It would be helpful if the federal government would provide an explanation of why Equalization payments have shifted for this coming year.

— Noah Zon

Related research

Slicing the Pie

Two thirds of the federal government’s budget each year are redistributed to provinces and territories, organizations and people through transfer payments.

View this paper

Cheques and Balances

This Mowat Note uses refined methodology to look at how how regional redistribution is being carried out by the Canadian government, and to assess the net annual contribution Ontarians make to the federal government.

View this paper

Back to Basics

In the fifth paper in the Fiscal Transfers Series, Matthew Mendelsohn argues that Canada’s system of fiscal arrangements is misaligned with current economic realities.

View this paper